Learning personal finance and stock market investing used to mean paying thousands for seminars, courses, or financial advisors. Today, you can build genuine expertise by combining free resources with affordable tools that put real market data in your hands.

This guide shows you how to develop professional-level investing knowledge without breaking the bank.

The Problem with Traditional Finance Education

Most investing courses charge $500 to $5,000 for information freely available elsewhere. They sell confidence, not knowledge. What you actually need is consistent exposure to real market concepts and hands-on practice with actual data.

The expensive coaching industry thrives on complexity. Financial advisors benefit when you feel overwhelmed. But the core concepts of stock analysis aren't rocket science—they require deliberate learning.

Free Resources That Actually Work

Before spending anything, tap into these free sources:

Reddit communities offer surprisingly valuable education. Subreddits like r/investing, r/stocks, r/ValueInvesting, and r/SecurityAnalysis contain years of discussions, book recommendations, and real analysis from both beginners and professionals. The community will quickly correct misconceptions—sometimes harshly, but effectively. Search past threads before asking questions; most beginner topics have been covered extensively.

SEC EDGAR provides every public company's financial filings for free. You can read the same 10-K annual reports and 10-Q quarterly reports that professional analysts study.

Investopedia explains virtually every financial term with examples. It's the Wikipedia of finance education.

The challenge with free resources? They're scattered. You need to piece together your own curriculum and stay disciplined without structure.

The Three Pillars of Self-Taught Finance Expertise

1. Learn the Vocabulary First

Every field has its language. Finance includes terms like P/E ratio, RSI, MACD, ROE, EPS growth, and debt-to-equity ratio. You don't need to memorize formulas. You need to understand what each metric tells you about a company's health and value.

Flash cards and quizzes work remarkably well for this. Repetition builds intuition. When you can glance at a P/E of 45 and immediately think "expensive relative to earnings," you're building the pattern recognition that professional analysts develop over years.

2. Read Real Company Filings

The SEC requires public companies to file detailed reports. These include 10-K annual reports, 10-Q quarterly reports, and 8-K filings for significant events. Every S&P 500 company's financials are public record.

Reading these documents teaches you more than any course. You see how companies describe their business risks, revenue sources, and competitive position. After reviewing 20-30 filings, you develop an intuitive feel for what matters.

3. Practice Screening Stocks with Real Data

Theory without application stays theory. You need to filter stocks by actual criteria: companies with ROE above 15%, debt ratios below 0.5, or RSI indicating oversold conditions.

This hands-on screening builds practical skill. You start recognizing which metrics correlate with performance in different market conditions.

Affordable Tools That Accelerate Your Learning

Professional-grade screeners like Bloomberg Terminal cost $20,000+ annually. But you don't need institutional tools to learn.

Signal Screener offers an educational approach for just $1 per week (also available in € and £). Here's the key insight: you don't need a continuous subscription. Subscribe when you're ready to pick a stock, use it for your research, then cancel. If you pick stocks monthly, your effective cost is about $1 per month.

The app combines:

- 100-day quizzes for progressive learning with daily challenges

- Flash cards for visual education on 30+ investing concepts

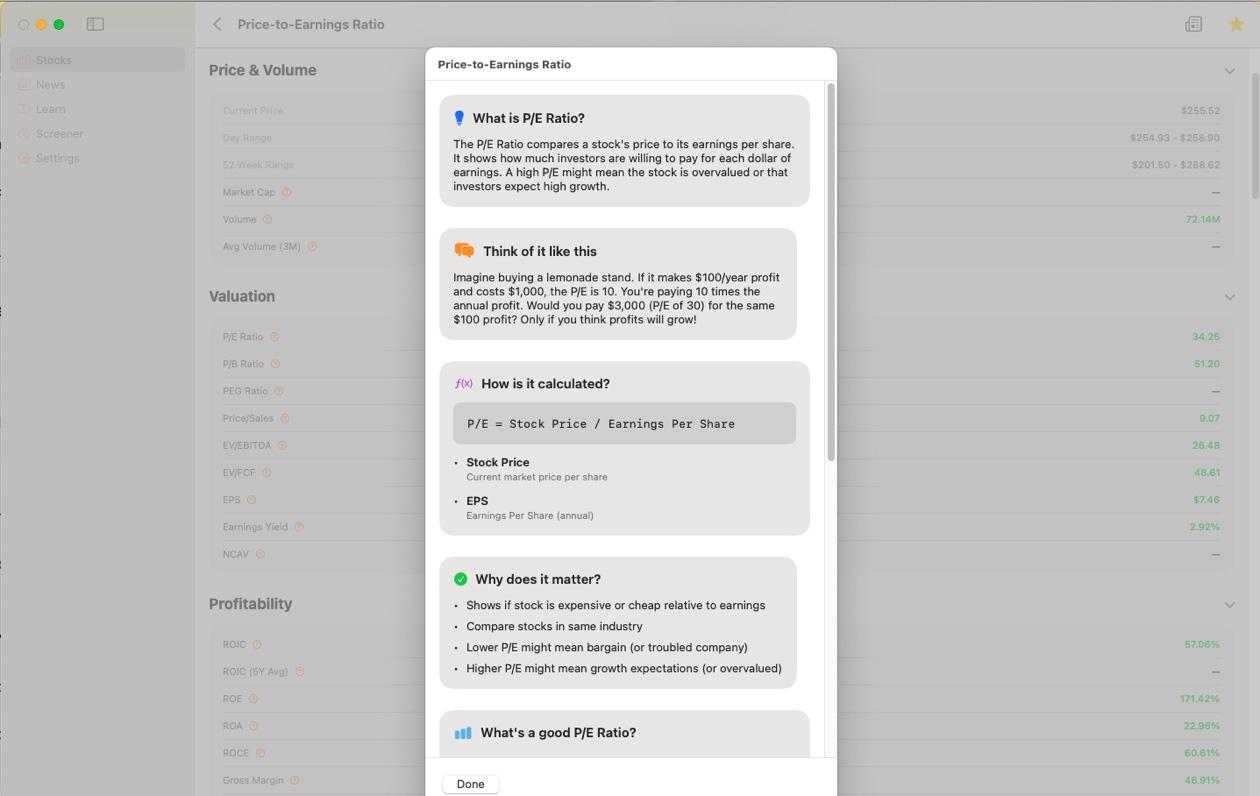

- In-depth indicator education — tap any ratio or metric to see a full explanation with real-world examples (like comparing P/E to buying a lemonade stand), the exact calculation formula, why it matters, and what values are considered good or bad

- Clear color coding — green and red visual indicators instantly show whether metrics are favorable or concerning, so you can scan stocks quickly without memorizing thresholds

- SEC filing browser with real 10-K, 10-Q, and 8-K documents from S&P 500 companies

- Stock screener covering 8,000 US stocks with custom filters for valuation, quality, technical signals, and growth metrics

Available on iPhone, iPad, and Mac.

The goal isn't to get rich quick. It's to build the knowledge foundation that lets you make informed decisions.

Building Your Self-Education Curriculum

Phase 1: Vocabulary Foundation (Weeks 1-3)

Spend 10 minutes daily learning key metrics. Focus on:

- Valuation ratios: P/E, P/B, EV/EBITDA, Price-to-Sales

- Quality indicators: ROE, ROA, operating margin, net margin

- Stability metrics: debt-to-equity, current ratio, interest coverage

Use Signal Screener's 100-day quizzes or Investopedia's dictionary. Reddit's r/investing sidebar has excellent beginner guides.

Phase 2: Filing Literacy (Weeks 4-6)

Pick three companies you know—Apple, Amazon, Coca-Cola—and read their latest 10-K annual reports. Focus on:

- Risk factors section (what could go wrong)

- Management discussion (how executives view the business)

- Revenue breakdown (where money actually comes from)

Don't try to understand everything. Notice patterns in how companies present information.

Phase 3: Screening Practice (Weeks 7-9)

Create simple screens: "companies with P/E under 20" or "stocks with ROE above 15%." Explore what appears in each filter. Compare results.

Signal Screener lets you combine fundamental and technical criteria across 8,000 US stocks. The color-coded results make it easy to spot quality companies at a glance—green metrics indicate strength, red flags potential concerns. Try different approaches:

- Value: Low P/E + low debt + positive cash flow

- Quality: High ROE + growing revenue + expanding margins

- Technical: Oversold RSI + above 200-day moving average

Phase 4: Combined Analysis (Weeks 10-12)

Build screens combining fundamentals and technicals. "Quality companies (high ROE) that appear oversold (low RSI)." This multi-factor approach is how professionals work.

Research your top candidates in SEC filings. Make one informed selection.

Phase 5: Develop Your Framework (Ongoing)

Write down your personal criteria for an attractive stock. What matters to you? Growth? Dividends? Value? Your framework becomes your investing identity.

Share your analysis on Reddit for feedback. The community will identify blind spots you missed.

What You Won't Learn from Expensive Courses

The finance industry sells certainty. "Follow these signals and profit." Reality is messier.

Self-education teaches you humility. You learn that indicators fail, predictions miss, and markets move irrationally. This skepticism protects you from costly mistakes.

You also learn your own psychology. When you practice screening and see volatile stocks, you discover whether you handle risk well. This self-knowledge prevents panic selling.

Common Mistakes Self-Taught Investors Avoid

Overcomplicating analysis: More indicators don't mean better decisions. Master five metrics deeply before adding more.

Ignoring context: A P/E of 30 means different things for a utility company versus a tech startup. Sector matters.

Chasing hot tips: Every financial education prepares you to evaluate claims yourself rather than following crowds.

Neglecting diversification: Understanding stock selection makes diversification feel less necessary—but it remains essential.

Skipping the filings: Numbers without context mislead. Always read what management says about their business.

The Complete Resource Stack (From Free to $1)

Completely Free:

- Reddit communities (r/investing, r/ValueInvesting, r/stocks)

- SEC EDGAR for company filings

- Investopedia for definitions

- Company investor relations pages

$1/week (use as needed):

- Signal Screener for structured learning + screening with built-in education for every metric

Your time investment:

- 10-15 minutes daily for concepts

- 2-4 hours monthly for stock research

Total annual cost if picking stocks monthly: approximately $12-15.

Start Today, Not Tomorrow

You don't need permission to learn finance. The SEC filings are public. Reddit discussions are free. The concepts are documented. The tools are affordable.

The only barrier is starting. Begin with Reddit's beginner guides, commit to 10 minutes daily on vocabulary, and when you're ready for structured practice, grab Signal Screener for a week.

Your financial literacy compounds like interest. Every concept learned makes the next easier. In one year, you'll understand more than most people who paid thousands for coaching.

Frequently Asked Questions

Do I need a finance degree to understand stock investing?

No. Stock investing fundamentals can be learned through self-education. Key concepts like P/E ratios, company filings, and basic technical indicators are accessible to anyone willing to spend consistent time learning. Reddit communities and tools like Signal Screener make this knowledge more accessible than ever.

How much does it cost to learn stock market investing on your own?

Virtually nothing for information—SEC filings are free, Reddit communities are free, and educational content is abundant online. For structured practice with real market data, Signal Screener costs $1/week, and you only need to subscribe when actively researching—making monthly stock picking cost about $1 total.

What are the most important metrics to learn first?

Start with P/E ratio (price relative to earnings), ROE (return on equity), and debt-to-equity ratio. These three metrics tell you if a company is expensive, profitable, and financially stable.

How do I know if a metric is good or bad for a stock?

Tools like Signal Screener use green/red color coding to instantly show whether metrics are favorable or concerning. You can also tap any ratio to see a full explanation with examples, the calculation formula, why it matters, and typical value ranges for different situations.

How long does it take to become competent at stock analysis?

With consistent daily practice of 10-15 minutes, most people develop functional competence in 3-6 months. True expertise develops over years of continued learning and market observation.

Should I pay for an investing course or coaching?

For most people, no. The knowledge in premium courses exists freely on Reddit, Investopedia, and in SEC filings. What you actually need is consistent practice with real data, which affordable tools like Signal Screener provide for a fraction of the cost.

Where can I discuss stocks and get feedback on my analysis?

Reddit communities like r/investing, r/ValueInvesting, and r/stocks have active discussions. Post your analysis and reasoning—experienced investors often provide detailed feedback.